The USL Financials Bank Reconciliation module interfaces easily with Accounts Payable and Accounts Receivable to provide important functionality for every kind of business.

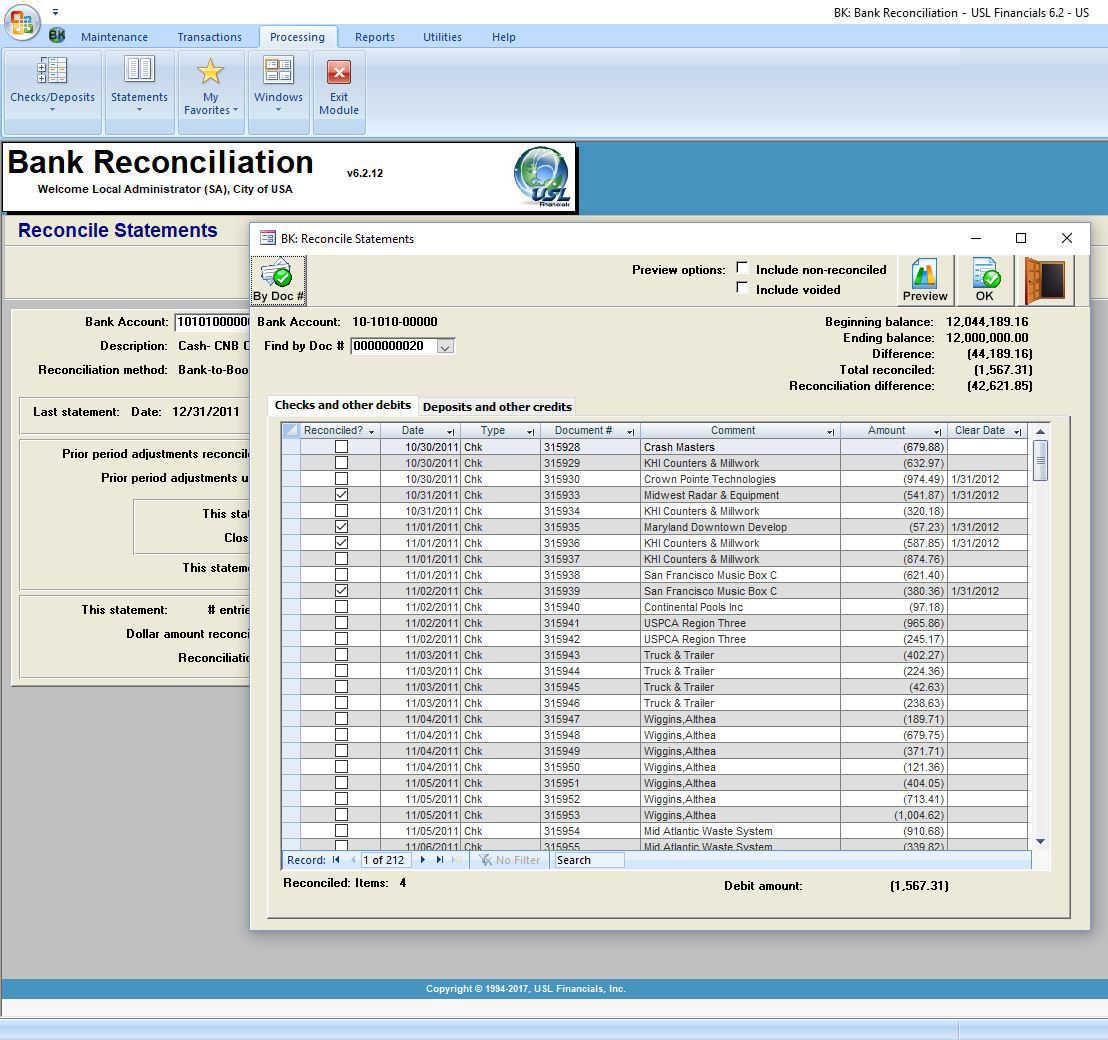

In the USL Financials Bank Reconciliation module, checks and deposits are transferred from the Accounts Payable and Accounts Receivable modules for full account reconciliation. Cleared checks and deposits are manually identified or uploaded from the bank, and the adjusting entries and service fees are posted to the General Ledger.