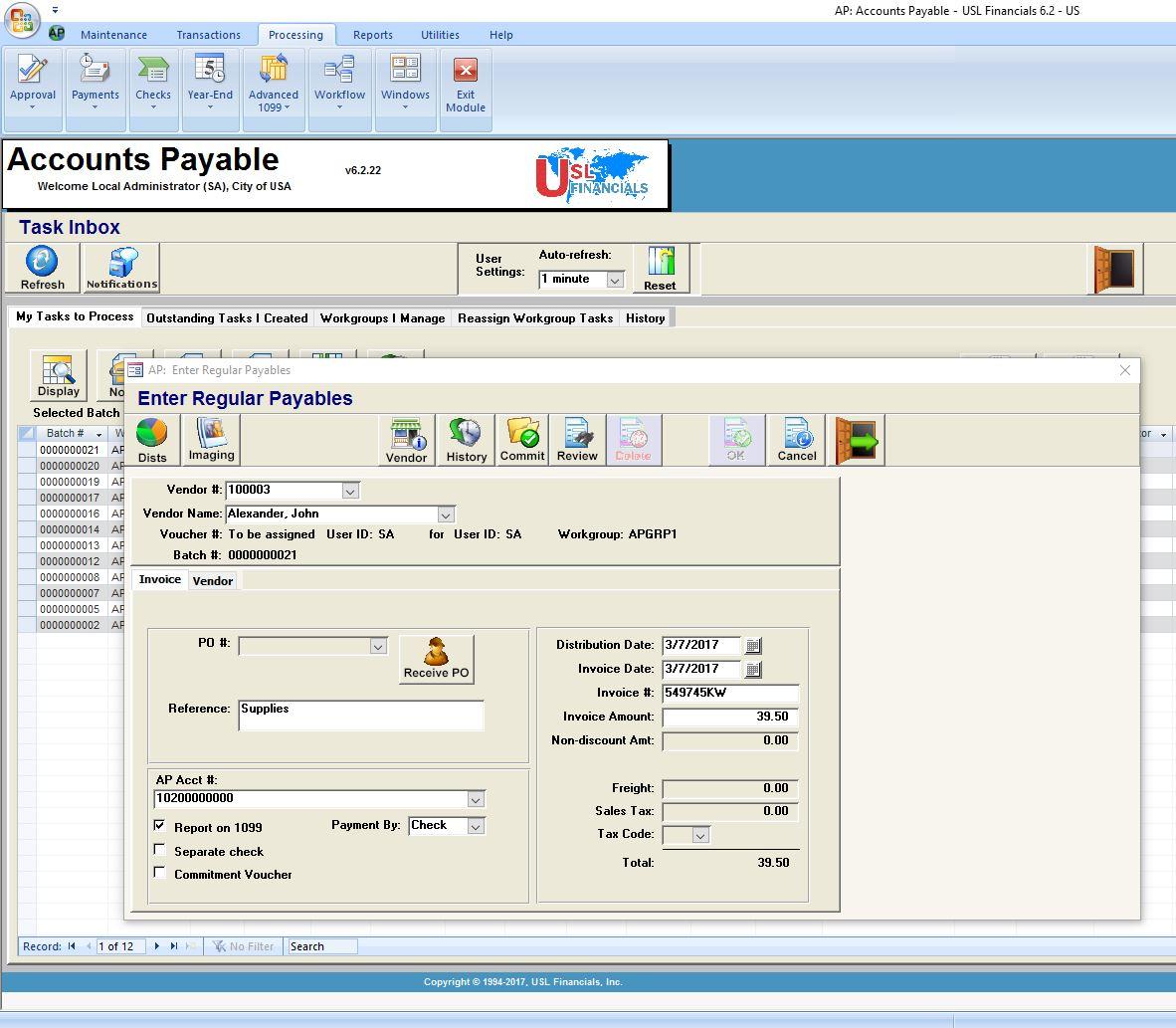

USL Financials Accounts Payable contains all the functions necessary to track, distribute and pay invoices. This module integrates with the Purchase Order, Inventory Management, Project Accounting and Fixed Assets modules to price and quantify purchase orders created by the system.

On-line inquiries are fast and comprehensive with USL Financials. View a vendor’s Invoice History, Open Items or Checks with complete filtering and sort capabilities, full drill-down to details and easy export to Excel and other MS Office Products.