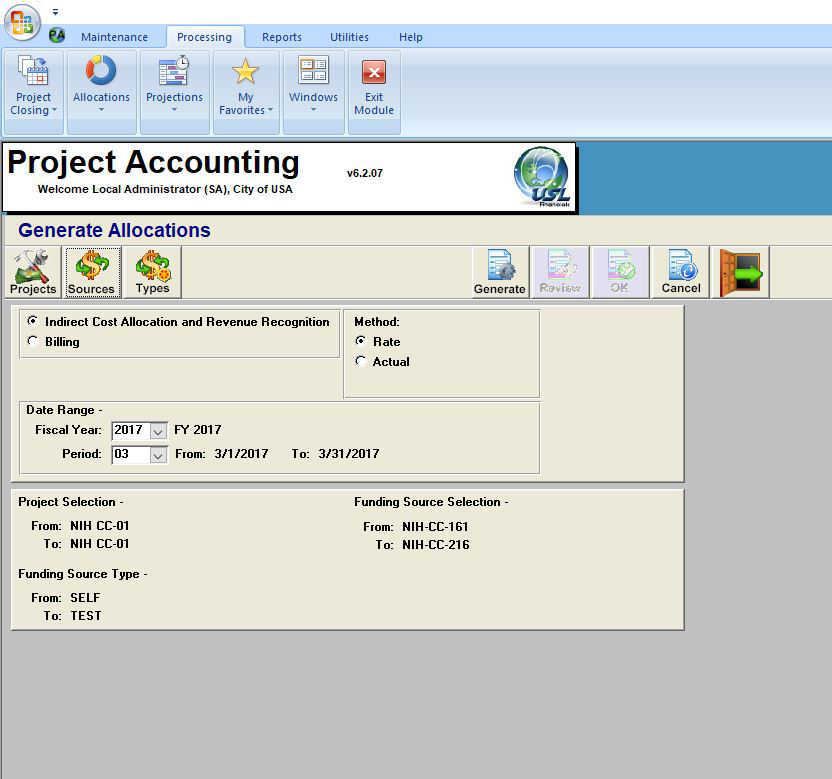

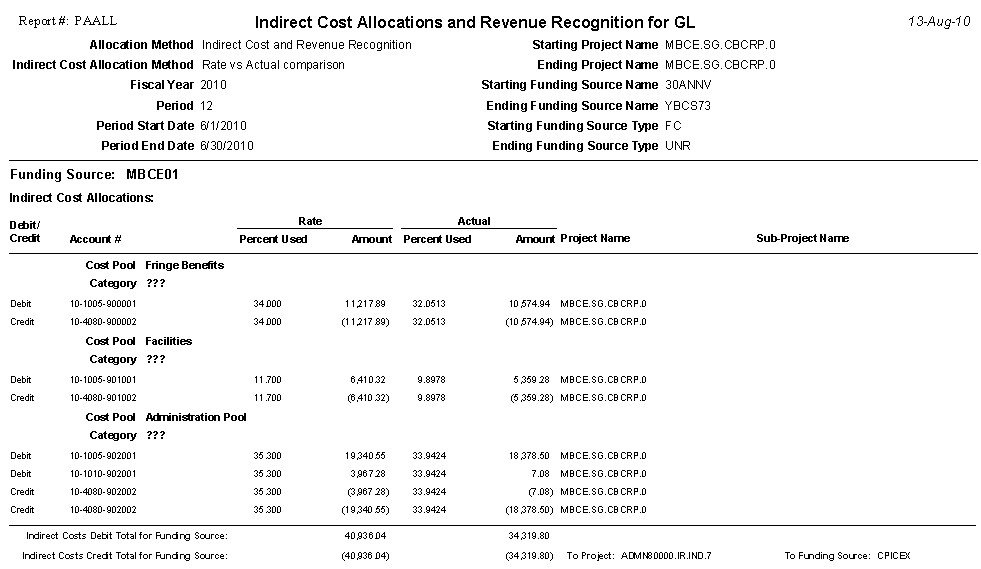

USL Financials Allocation modules contain all of the necessary functions to perform data extraction, manipulation and posting. Any data stored in the General Ledger or Project Accounting modules can be used as a source or basis for allocations, and computed results can be reviewed before posting.

The Allocation modules have features specifically designed for the non-profit and government markets. Allocations are integrated with the General Ledger and Project & Grant Accounting modules. Some of the various types of allocations provided include: Indirect Costs and Revenue Recognition; Fringe Benefits; Interest; and Costs such as Telephone or Postage.